| Selling Your Business: Selling a High-Growth Tech Company

So you’re thinking about selling your fast-growing technology company, what happens next? Being the owner or manager of a tech company, the odds are that you have given this more thought than most business owners, but the question still remains – how to sell it for a high valuation?

|

| Selling Your Business: Without Advertising

Most business owners would prefer to sell without advertising. Unfortunately, it is hard to market a secret.

|

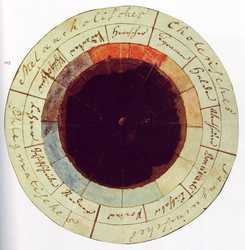

| Selling Your Business: The Zone Of Possibility AgreementThe zone of possible agreement (“ZOPA”) is the “contract zone” – the place where you can get the deal that you wanted – at least the deal that you would be happy with.

|

| Selling Your Business: A Tear Down of Earn Outs - Part One

Earn outs are a way of bridging the valuation gap where the seller thinks the business or company is worth more than the buyer does – which is most of the time. The earn out is an amount of money that is paid after settlement if the target company or business achieves agreed KPIs in

|

| Selling Your Business: A Tear Down of Earn Outs - Part TwoWhen you are selling a business for one price and the buyer is offering a lower price, an earn out is a way of meeting in the middle. This is the second post looking at earn outs in detail. Earn outs usually depend on the target hitting agreed KPIs after settlement. They arise in two classic situations:

|

| Selling Your Business: A Tear Down of Earn Outs - Part ThreeAn earn out is a mechanism where part of the purchase price for a company or business is payable after settlement, contingent on the results of the target during the earn out period. It’s one thing when the target performs as expected, but what happens when the unexpected occurs? One unexpected event (at least for the seller) is when.

|

| Selling Your Business: Negotiation and Your BATNA (Best Alternative to a Negotiated Agreement)

"In every negotiation it must be assumed – unless you are dealing with juveniles – that your opposite numbers will always table maximum positions first. Equally important, it must be assumed – unless you are dealing with fools – that your opposite numbers have not disclosed their minimum positions in any manner.”

|

| Selling Your Business: Multiparty and Multiphase Negotiations

When thinking of negotiations, most people envisage two parties hammering out a deal. Often however, there are more than two parties, more than two places and more than one time period.

|

| Selling Your Business: Bridging The Valuation Gap With An Earn Out

There is an old saying in M&A: “The money you see at settlement is all the money you are ever going to see.” So why do people agree to earn outs – mechanisms where 15%-30% of the purchase price is paid over time after settlement depending on whether certain KPIs are reached? The answer is that […]

|

| Selling Your Business: The Best Time To Sell Your Business

In the next ten years, $1.6 trillion in wealth will be transferred because of the retirement of Australian family business owners. Many of these are substantial, multi-million dollar businesses. This will lead to a tsunami of businesses being put up for sale as baby boomers seek to cash out and fund their retirement all at […]

|

| Selling Your Business: Preparing Your Business For Sale Part One

Selling your business is the triumphant validation of your hard work and ambition. It means someone other than you has bought into your dream.

|

| Selling Your Business: Preparing Your Business For Sale Part Two

The problem for many people when they sell their business is that they leave millions on the table – just because they don’t understand how business exits work. When selling your business, you need to be “Investor Ready” which means that you need to reduce the risk in the business and increase the profitability.

|

| Selling Your Business: Carsales.com.au Strategic Investment in Stratton Finance

What makes your company a “strategic acquisition” for a bigger company? If you can answer this question, the stage is set for a business exit at high multiples. An illustration of this principle is found in the acquisition of shares in Stratton Finance by carsales.com.au. Carsales is an online car advertising group in Australia. It […]

|

| Selling Your Business: Personal Reasons to Sell Your Business

Accountants and MBAs can tell you when external events dictate it is time to sell your business. Sometimes, however, there are personal events that dictate a business exit. The trick is recognising that such events may put your business at risk and moving quickly to exit. The fact is that once one or more of […] |

| Selling Your Business: Corporate Reasons to Sell Your Business

The true test of your success as a business person is not how much revenue you produce, or how many distributors you have or how many countries are your export destinations. The true test comes when you sell your business: were you able to convince someone other than yourself to buy into the dream? |

| Selling Your Business: Memorandum of Understanding and Heads of Agreement

Increasingly I am asked by negotiating parties to get a Memorandum of Understanding or Heads of Agreement, as some sort of half-way house between negotiations and a final sale agreement or other commercial contract. My usual question is, “Why bother?”. |

| Selling Your Business: Problems with Memorandum of Understanding and Heads of Agreement

These days, business agents, investment banks, accountants and many clients have come to believe that Memoranda of Understandings and Heads of Agreement are an essential part of the transaction documents. They are not. |

| Selling Your Business: The Information Memorandum

The Information Memorandum (“IM”) is the pivotal document in all your discussions leading up to the legal agreements. It does two things: it sells your business to the investor and it also protects you from litigation if things later head south. |

| Selling Your Business: The Look and Feel of Your Information Memorandum

The IM must deliver an emotional impact to the unconscious mind of potential investors whilst also addressing the logic of their conscious minds. The IM must be part of an emotionally satisfying sale process that starts with the Elevator Pitch and ends with a signed Subscription Agreement. |

| Selling Your Business: The Cooks Tour of Your Premises

At the conclusion of your first investor presentation, the next step is to invite interested investors to visit your premises. This is usually the first of at least two visits. |

| Selling Your Business: The Ten Slide Deck

You walk into a meeting room and sit down opposite a group of professional investors. Fortunately, you don’t have to wing your investment presentation because you have your Ten Slide Deck ready to go. |

| Selling Your Business: How To Develop A Ten Slide Deck

The Ten Slide Deck is the cornerstone of your presentation to investors. Follow these easy steps to give them the information in the way they are used to hearing it. |

| Selling Your Business: The One Pager

When you consider how busy venture capitalists and professional investors are, it makes sense to give them all your information in an easily digestible form. And what could be better than giving it to them on a single page? Mark Twain once said, “I didn’t have time to write a short letter, so I wrote […] |

| Selling Your Business: The Ten Minute Pitch

The Ten Slide Deck is largely visual, so how will investors hear what you have to say? The answer is in the Ten Minute Pitch. In your meeting, whilst the Ten Slide Deck is being shown to potential buyers, you (in your role as either the entrepreneur or the CEO) go through each slide and […] |

| Selling Your Business: The Non-Disclosure Agreement

Sooner or later you are going to have to “open the kimono” and hand over sensitive company information to potential investors or purchasers. How do you ensure they have enough information to give you an indicative offer, but your information doesn’t end up all over town? |

| Selling Your Business: Issues With Non-Disclosure Agreements

You sign an NDA, but what happens if the recipient discloses your information anyway? Now your deal is a secret all over town. |

| Selling Your Business: Your Company SentenceTo prove to a potential buyer of your business that you truly have a differentiated product, you need to be able to sum up what your company does in a single sentence. It shows you have the discipline to think this one through and it also positions your company as a strategic acquisition in the mind of the buyer. |